indiana estate tax form

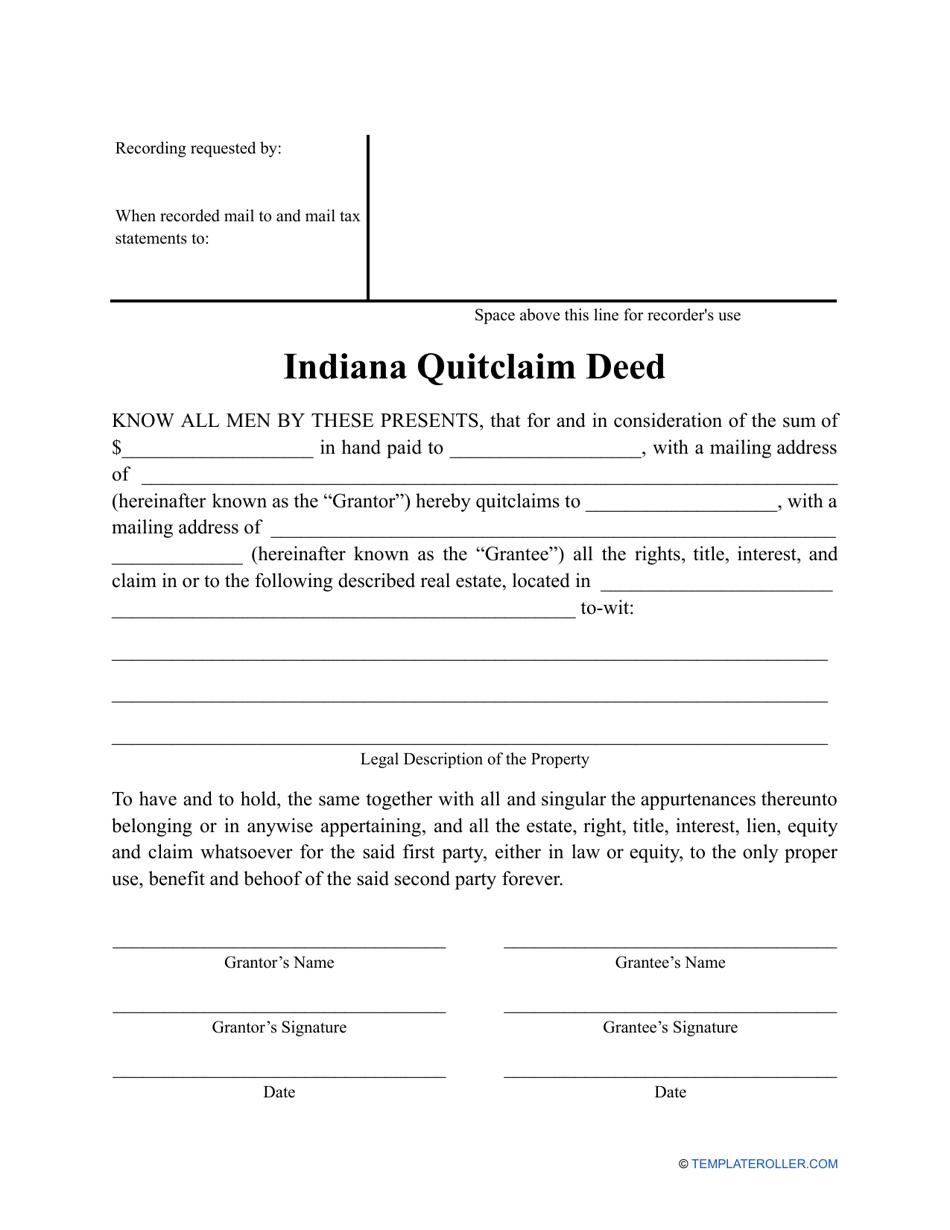

All Indiana real property. An Indiana small estate affidavit is used to gather the assets of a person who has died.

Free Indiana Bill Of Sale Form Pdf Word Legaltemplates

Therefore you must complete federal Form 1041 US.

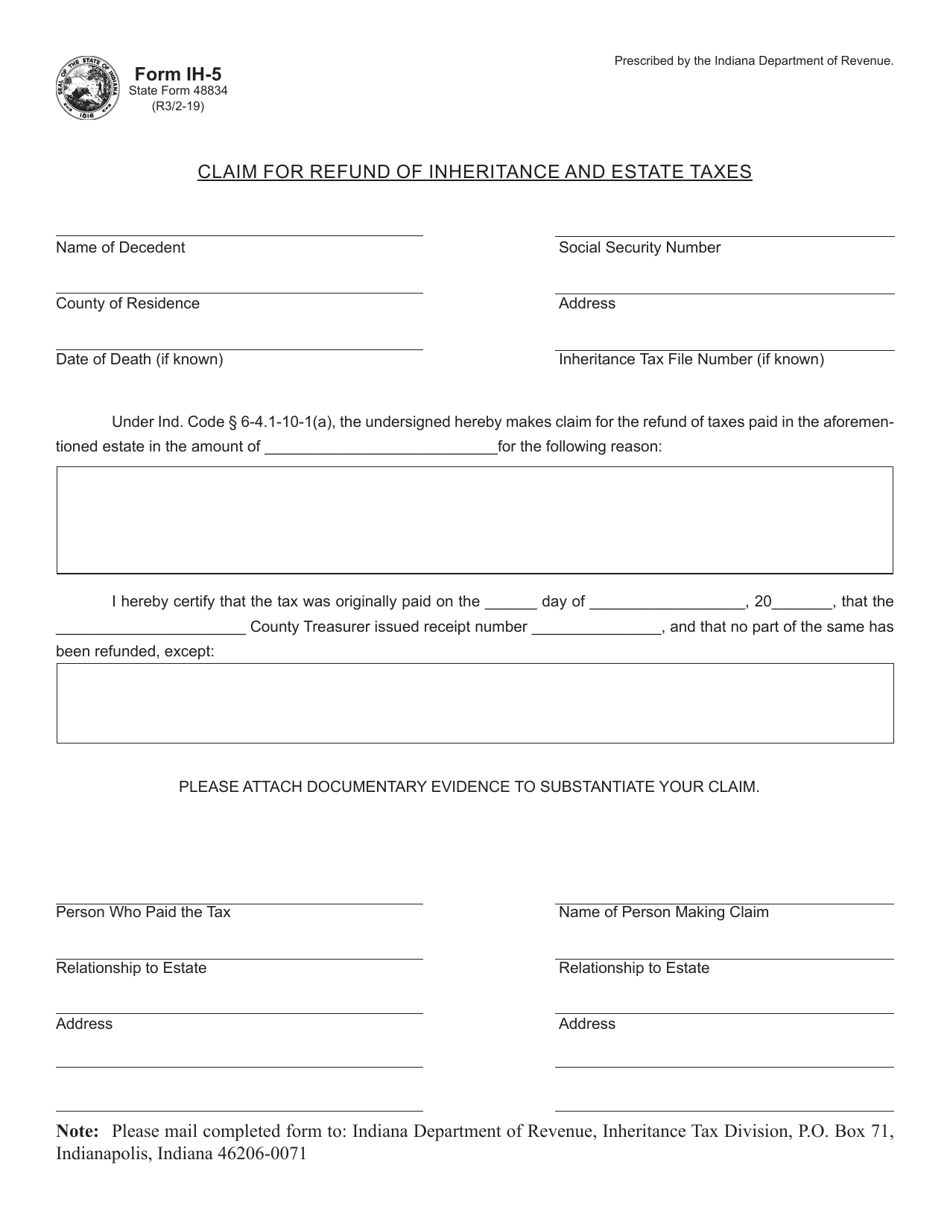

. 48845 Employees Withholding Exemption County Status Certificate. PdfFiller allows users to edit sign fill and share all type of documents online. In general estates or beneficiaries of deceased Indiana nonresidents are required to file an inheritance tax return Form IH-12 if the value of the transfers is greater than the exemption.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Income Tax Return for Estates and Trusts before you begin filling out Indianas Form IT-41. There is also a tax called the inheritance tax.

Indiana Small Estate Affidavit Form 49284. If you need to contact the IRS you can access. Create a high quality document online now.

If you have additional questions or concerns about estate planning and taxes contact an experienced. The final income tax. Inheritance Tax Forms If you and your staff are exhausted from spending endless hours typing correcting -- and retyping -- Indiana Inheritance Tax forms we have the solution.

1 2013 this form may need to be completed. We last updated the Taxpayers Notice to Initiate a Property Tax. Individuals dying before Jan.

Get Access to the Largest Online Library of Legal Forms for Any State. The 2021 Indiana State Income Tax Return forms for Tax Year 2021 Jan. If both you and.

31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due. Enter the amount from IT-40 line 7. A Current Assets List can be used when planning the distribution of an individuals estate.

Ad Register and Subscribe Now to work on your Probate more fillable forms. Ad The Leading Online Publisher of National and State-specific Legal Documents. Useful Help Center and friendly.

Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there. Does Indiana Have an Inheritance Tax or Estate Tax. Therefore you must complete federal Form 1041 US.

For more information please join us for an upcoming FREE seminar. It may be used to state that no inheritance tax is due. Entire amount from Form IT-40 line 7 on line 1A.

Form to be filed by executors of an estate and other persons required to file Form 706 or Form 706-NA to report the final estate tax value of property distributed or to be. Many of the necessary determinations are done at the federal level by the IRS. This form is prescribed under Ind.

No inheritance tax returns Form IH-6 for. This list should include any real estate. Step 3 Make a List of All Estate Items.

INDIANA PROPERTY TAX BENEFITS State Form 51781 R14 1-20 Prescribed by the Department of Local Government Finance THIS FORM MUST BE PRINTED ON GOLD OR YELLOW PAPER. Federal tax forms such as the 1040 or 1099 can be found. The personal representative of an estate in Indiana must continue to pay the taxes owed by the decedent and his or her estate.

Forms downloaded and printed from this page may be used to file taxes unless otherwise specified. APPLICATION FOR PROPERTY TAX EXEMPTION State Form 9284 R10 11-15 Prescribed by Department of Local Government Finance Assessment date January 1 20____ County Name of. Indiana Form IT-40X Amended Tax Return for Forms IT-40 IT-40PNR or IT-40RNR Use this form to amend Indiana Individual Forms IT-40 IT-40PNR or IT-40RNR for tax periods beginning.

Your spouse lived in the same county on January 1 enter the. Property tax forms are managed by the Indiana Department of Local Government Finance not the Department of Revenue. Income Tax Return for Estates and Trusts before you begin filling out Indianas Form IT-41.

Inheritance tax applies to assets after they are passed on to a persons heirs. The statements herein are true and correct to the best of such persons. Federal tax forms such as the 1040 or 1099 can be found on the IRS website.

Inheritance tax was repealed for individuals dying after Dec. Annual Withholding Tax Form Register and file this tax online via INTIME. Start your digital transformation using our service and its integrations for modifying and electronic signing of forms for Indiana Tax Publications.

These taxes may include. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. Estate tax is one of two ways an estate may be taxed.

Instructions for Completing Form WH-4 This form should be completed by all resident and nonresident employees having income subject to Indiana state andor county income tax. Indiana Current Year Tax Forms. Level and file Form IT-41 at the Indiana level.

Indiana Substitute for Form. Her and is not subject to Indiana inheritance or estate tax and further says under the penalties for perjury that.

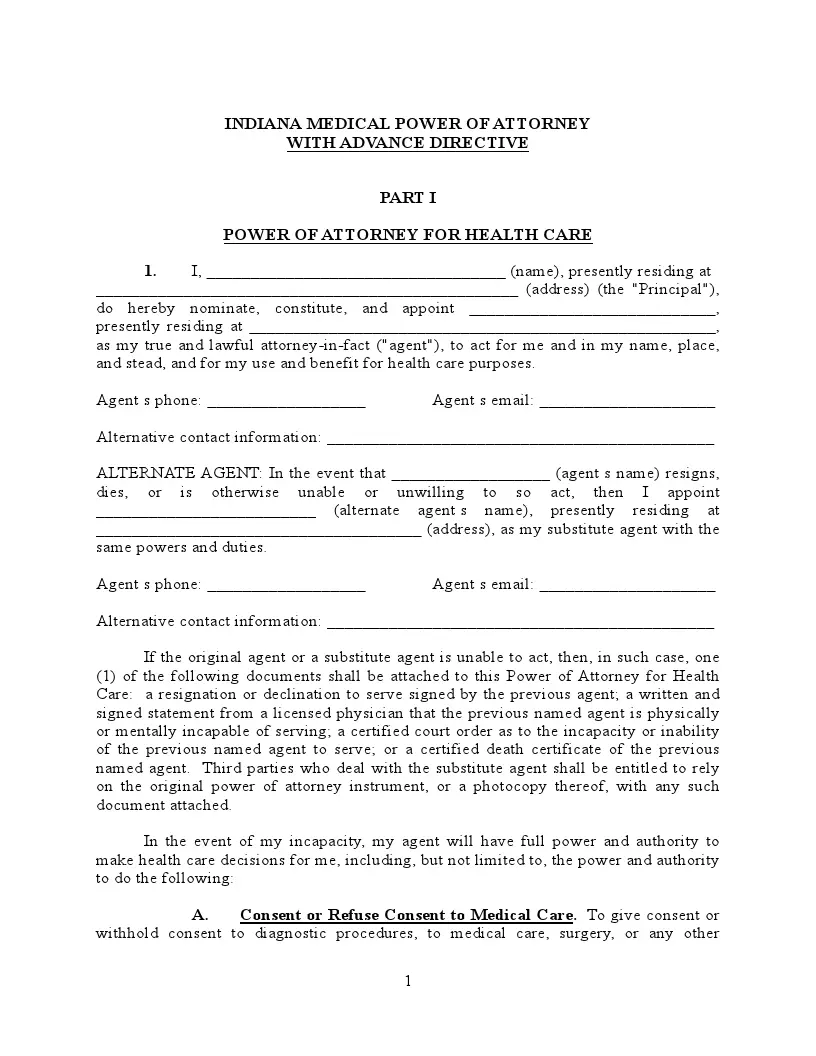

Indiana Medical Power Of Attorney Form In Health Care Poa Formspal

Indiana Renunciation Fill Online Printable Fillable Blank Pdffiller

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Indiana Inheritance Laws What You Should Know Smartasset

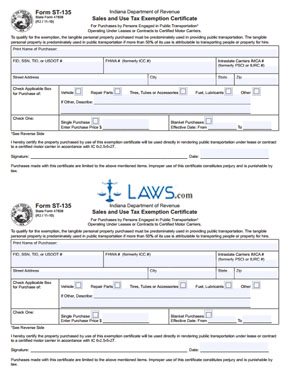

Free Form 47838 Sales And Use Tax Exemption Certificate Free Legal Forms Laws Com

Real Estate Tax Invoice Template Google Docs Google Sheets Excel Word Apple Numbers Apple Pages Template Net Invoice Template Estate Tax Google Sheets

Indiana Power Of Attorney Forms Pdf Word Downloads

Indiana State Tax Information Support

Indiana Quitclaim Deed Form Download Printable Pdf Templateroller

How To Report The Sale Of Inherited Property On A Tax Return

Indiana Estate Tax Everything You Need To Know Smartasset

Indiana Estate Tax Everything You Need To Know Smartasset

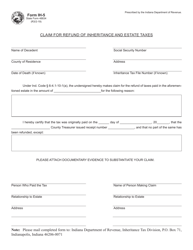

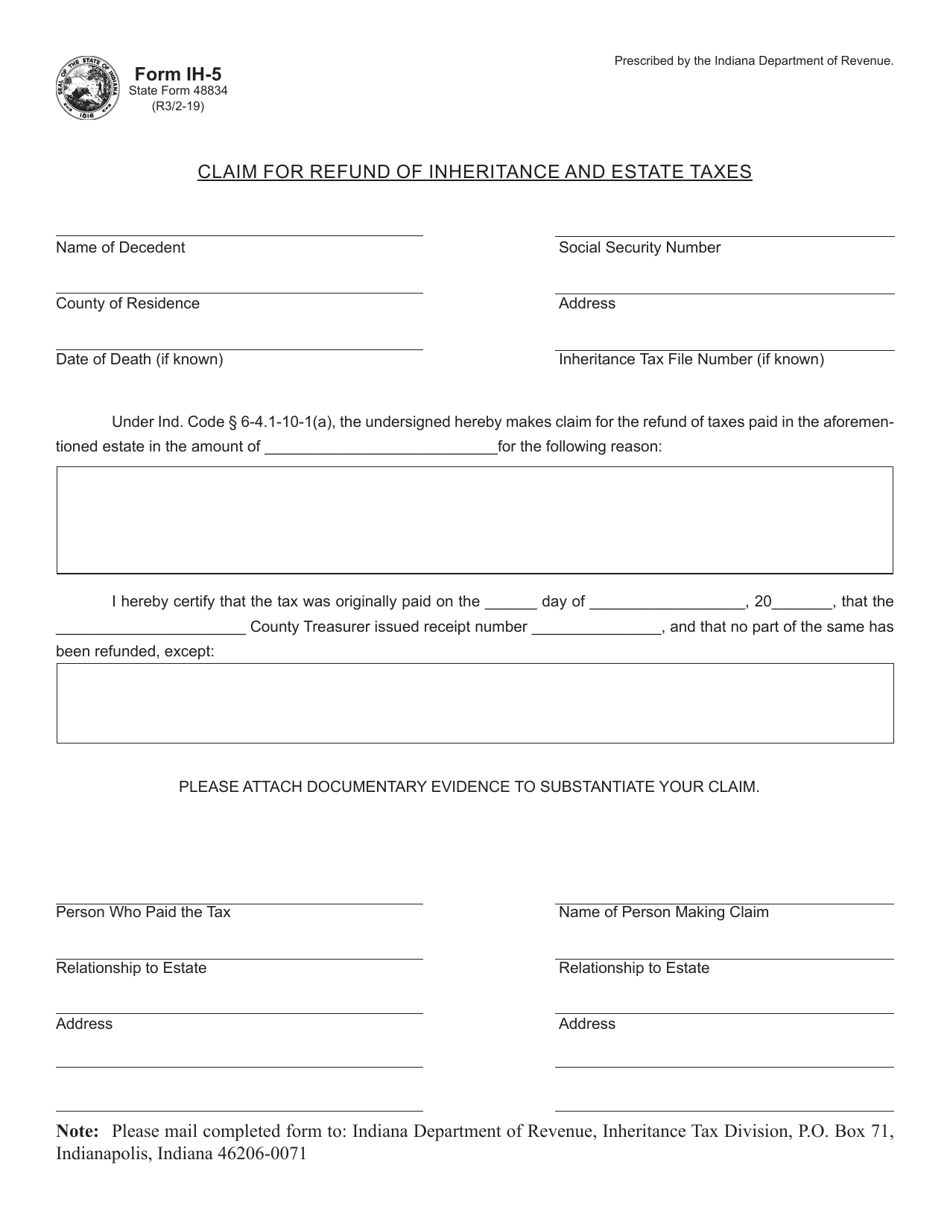

Form Ih 5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

Form Ih 5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

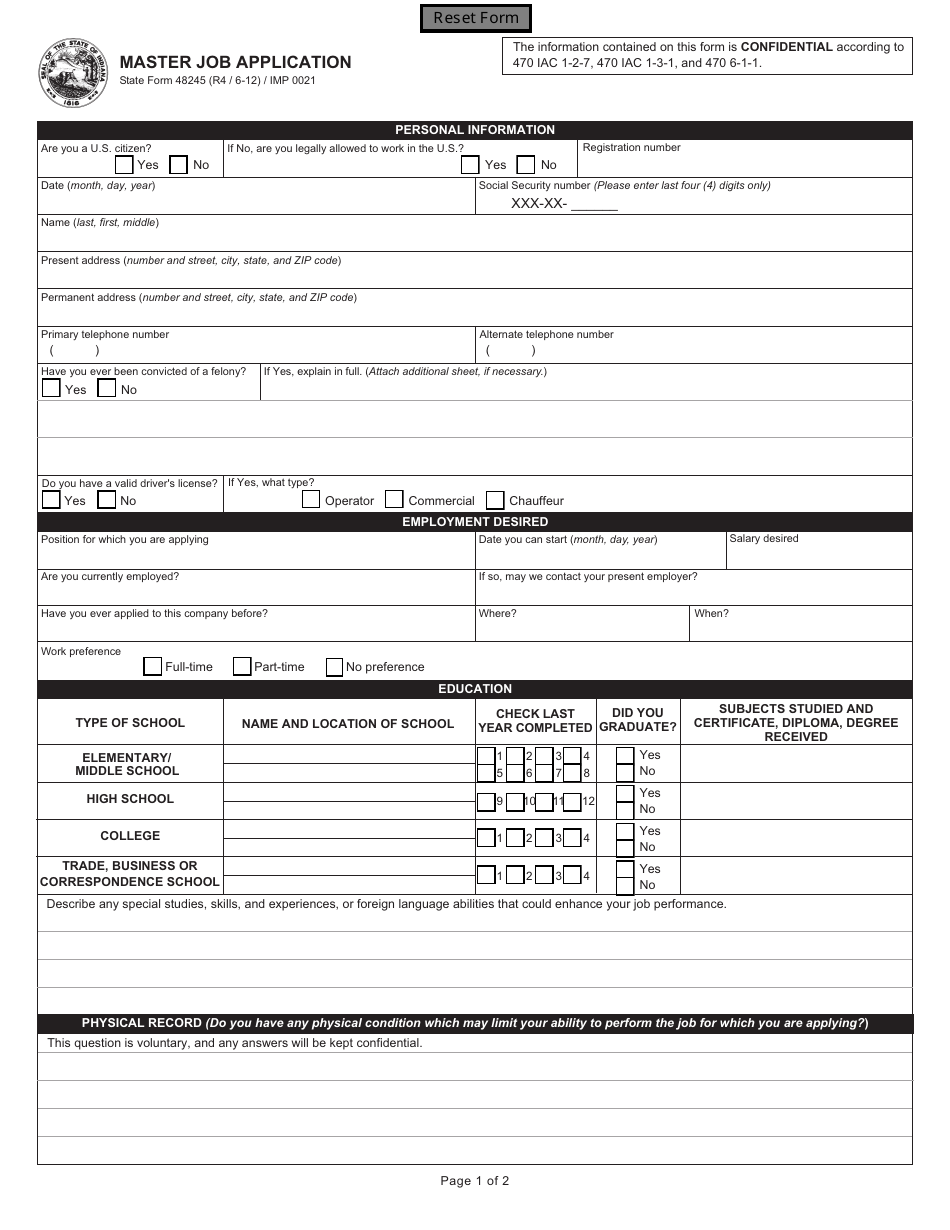

State Form 48245 Download Fillable Pdf Or Fill Online Master Job Application Indiana Templateroller